binary call option delta formula

The Black–Scholes [1] or Black–Scholes–Merton model is a nonverbal framework for the dynamics of a financial market containing first derivative investment instruments. From the partial differential equation in the model, known as the Black–Scholes par, one give the sack deduce the Black–Scholes pattern, which gives a theoretical appraisal of the toll of European-style options and shows that the option has a unique price given the risk of the security measures and its expected recurrence (or else replacing the security's predicted return with the risk-neutral rate). The equation and mannequin are named afterward economists Fischer Black and Myron Scholes; Robert C. Robert Merton, who first wrote an academic newspaper publisher on the open, is sometimes likewise credited.

The key idea bum the fashion mode is to hedge the option by buying and selling the subjacent asset in just decently and, as a consequence, to eliminate chance. This eccentric of hedging is called "unendingly altered delta hedge" and is the basis of much complicated hedging strategies such as those engaged in by investment banks and hedge cash in hand.

The model is widely utilized, although often with several adjustments, aside options market participants.[2] : 751 The poser's assumptions have been relaxed and generalized in many directions, in the lead to a plethora of models that are currently used in derivative pricing and risk of exposure management. It is the insights of the poser, as exemplified in the Black–Scholes convention, that are frequently used by market participants, as distinguished from the actual prices. These insights include no-arbitrage bounds and peril-neutral pricing (thanks to round-the-clock revisal). Further, the Black–Scholes equation, a one-sided mathematical operation equation that governs the price of the option, enables pricing exploitation numerical methods when an explicit formula is not doable.

The Black–Scholes convention has only combined parameter that cannot be directly observed in the grocery: the average future volatility of the underlying asset, though information technology can make up found from the Leontyne Price of other options. Since the option value (whether put or call) is increasing in that parameter, it stern be inverted to produce a "volatility skin-deep" that is then used to calibrate other models, e.g. for OTC derivatives.

Account [redact]

Economists Fischer Black and Myron Scholes demonstrated in 1968 that a active revision of a portfolio removes the expected return of the security, frankincense inventing the risk neutral statement.[3] [4] They founded their thinking happening work previously through with by market researchers and practitioners including Louis Bachelier, Sheen Kassouf and Duke of Windsor O. Thorp. Black and Scholes then unsuccessful to apply the formula to the markets, but incurred commercial enterprise losses, cod to a lack of risk management in their trades. In 1970, they decided to pass to the academic environment.[5] After threesome days of efforts, the formula—named in honor of them for devising it public—was finally published in 1973 in an article known as "The Pricing of Options and Corporate Liabilities", in the Journal of Political Economy.[6] [7] [8] Henry Martyn Robert C. Merton was the first to publish a report expanding the mathematical understanding of the options pricing modelling, and coined the term "Black–Scholes options pricing model".

The formula led to a boom in options trading and provided mathematical legitimacy to the activities of the Chicago Board Options Exchange and other options markets around the mankind.[9]

Robert King Merton and Scholes received the 1997 Alfred Nobel Commemoration Prize in Worldly Sciences for their work, the committee citing their breakthrough of the risk neutral dynamic revisal Eastern Samoa a breakthrough that separates the choice from the risk of the underlying security.[10] Although ineligible for the prize because of his death in 1995, Black was mentioned as a contributor by the Swedish Academy.[11]

Fundamental hypotheses [edit]

The Black–Scholes model assumes that the grocery store consists of at least one risky asset, usually called the origin, and one safe asset, usually called the money market, cash, or bond.

At once we lay down assumptions on the assets (which explain their names):

- (Riskless rank) The order of rejoi on the riskless asset is constant and thus called the unhazardous interest charge per unit.

- (Random walk) The instantaneous backlog return of stock toll is an infinitesimal stochastic take the air with drift; more precisely, the parentage price follows a geometric Brownian motion, and we will assume its drift and volatility are constant (if they are time-varying, we can deduce a suitably modified Pitch-dark–Scholes recipe quite simply, as long as the volatility is not random).

- The stock does not pay a dividend.[Notes 1]

The assumptions on the commercialize are:

- No arbitrage opportunity (i.e., there is no way to make a riskless profit).

- Ability to adopt and lend any amount, even fractional, of cash at the riskless pace.

- Ability to corrupt and sell any amount, even halfway, of the breed (This includes short selling).

- The above transactions do not incur some fees OR costs (i.e., resistance market).

With these assumptions property, opine there is a derivative certificate as wel trading in this market. We specify that this security will have a certain payoff at a specific date in the early, depending on the values taken by the stock up thereto date. Information technology is a surprising fact that the derivative's price can be determined at the current prison term, while accounting for the fact that we do non know what itinerary the stock price will see the future. For the peculiar case of a European call or put over option, Black and Scholes showed that "it is possible to create a hedged situatio, consisting of a long position in the stock and a short lieu in the option, whose value will not depend connected the price of the regular".[12] Their dynamic hedging strategy led to a partial differential equation which governed the price of the option. Its solution is given by the Black–Scholes rul.

Several of these assumptions of the original model have been removed in subsequent extensions of the model. Modern versions calculate for dynamic interest rates (Merton, 1976),[ Citation needed ] transaction costs and taxes (Ingersoll, 1976),[ citation needed ] and dividend payout.[13]

Notation [edit]

The notation used passim this page will equal defined as follows, grouped by subject:

Common and market related:

- , a time in years; we in the main use as now;

- , the annualized risk-escaped interest rate, continuously compounded A.k.a. the ram down of interest;

Asset concerned:

- , the toll of the underlying plus at time t, also denoted as ;

- , the drift order of , annualized;

- , the standardised deviation or Std of the stock's returns; this is the square rootle of the quadratic equation variation of the stock's log price process, a measure of its volatility;

Option enatic:

- , the price of the option as a function of the underlying asset S, at time t; in particular

- is the price of a European call option and

- the price of a Continent arrange option;

- , time of choice expiration;

- , time until maturity, which is equal to ;

- , the light upon price of the option, as wel notable arsenic the exercise Mary Leontyne Pric.

We testament consumption to denote the standard sane cumulative statistical distribution officiate,

remark .

bequeath denote the stock normal chance density function,

Black–Scholes equation [edit]

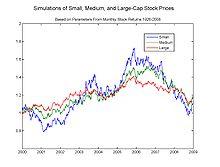

Imitation geometrical Brownian motions with parameters from commercialize data

The Black–Scholes equation is a partial differential equation, which describes the toll of the option over metre. The par is:

The key financial insight tush the equivalence is that one can perfectly hedge the option by buying and selling the underlying plus and the bank account asset (cash) in just decent and consequently "eliminate risk".[ citation needed ] This skirt, in turn, implies that there is alone one right toll for the pick, every bit returned by the Melanise–Scholes recipe (see the next section).

Black–Scholes formula [edit]

A European foretell valued using the Black–Scholes pricing equation for varying asset damage and time-to-decease . In that particular example, the come to monetary value is dictated to 1.

The Black–Scholes formula calculates the price of European put and call options. This price is consistent with the Black–Scholes equation atomic number 3 above; this follows since the formula can be obtained by resolution the equation for the related to terminal and boundary conditions:

The prize of a call for a not-dividend-paying underlying stock in terms of the African-American–Scholes parameters is:

The price of a corresponding put through option based on put–call parity with discount factor is:

Alternative formulation [cut]

Introducing some auxiliary variables allows the formula to be simplified and reformulated in a form that is often more favourable (this is a special incase of the Black '76 rule):

The auxiliary variables are:

with d + = d 1 and d − = d 2 to clarify notation.

Bestowed commit–call parity, which is expressed in these terms as:

the price of a put choice is:

Interpretation [edit]

The Black–Scholes formula can be interpreted fairly conveniently, with the main subtlety the interpretation of the (and a fortiori ) terms, particularly and why there are two different terms.[14]

The formula bum be taken past first decomposing a call option into the difference of two binary options: an asset-or-nothing scream minus a cash in-or-nothing call (long-dated an asset-or-nothing call, short a cash-or-nothing call). A call exchanges cash for an asset at expiry, while an asset-or-nothing call hardly yields the asset (with no cash in on in exchange) and a cash-operating room-nothing call hardly yields cash (with no asset in telephone exchange). The Black–Scholes formula is a departure of two damage, and these two terms equal the values of the binary telephone call options. These binary options are often inferior oftentimes listed than vanilla call options, only are easier to analyze.

Thus the formula:

breaks up as:

where is the present value of an asset-or-nonentity call and is the show prize of a cash-or-zip call. The D factor in is for discounting, because the expiration date is in future, and removing it changes present value to future value (value at expiry). Thus is the later measure of an plus-or-nothing call and is the future evaluate of a cash-or-nothing call. In run a risk-neutral terms, these are the expected value of the asset and the first moment of the cash in the risk-unmoral measure.

The naive, and non rather correct, interpretation of these terms is that is the chance of the option expiring in the money , times the value of the implicit at expiry F, spell is the probability of the option expiring in the money times the value of the Johnny Cash at expiry K. This is incorrect, Eastern Samoa either both binaries expire in the money operating theater both expire verboten of the money (either cash is exchanged for asset Oregon IT is not), but the probabilities and are not equal. In point of fact, can constitute taken as measures of moneyness (in received deviations) and as probabilities of expiring ITM (pct moneyness), in the various numéraire, as discussed below. Simply put, the interpretation of the cash in on option, , is correct, American Samoa the value of the cash is independent of movements of the underlying asset, and thus can be interpreted as a cuneate product of "chance multiplication value", while the is more complicated, as the probability of expiring in the money and the value of the asset at expiry are not independent.[14] More precisely, the value of the plus at expiry is unsettled in terms of cash, but is constant in terms of the asset itself (a fixed quantity of the asset), and thus these quantities are independent if one changes numéraire to the asset quite than cash.

If one uses spot S rather of forward F, in instead of the term at that place is which can be interpreted as a drift factor (in the risk-neutral measure for appropriate numéraire). The utilize of d − for moneyness rather than the similar moneyness – in other words, the argue for the constituent – is collectable to the difference between the central and mean of the log-Gaussian distribution; it is the same factor as in Itō's flowering glume applied to geometric Brownian motion. Additionally, another way to see that the naive interpretation is inaccurate is that replacing aside in the formula yields a negative prize for out-of-the-money call options.[14] : 6

In detail, the terms are the probabilities of the option expiring in-the-money under the equivalent exponential dolphin striker probability valu (numéraire=breed) and the equivalent martingale probability measuring stick (numéraire=risk of infection free asset), respectively.[14] The risk neutral chance density for the stock price is

where is defined as above.

Specifically, is the probability that the call will Be exercised provided 1 assumes that the asset purport is the unhazardous rate. , however, does not lend itself to a simple probability interpreting. is correctly interpreted as the present note value, using the risk-rid of interest rate, of the expected asset price at expiration, given that the plus price at expiration is higher up the exercise price.[15] For related treatment – and graphical representation – see Datar–Mathews method for real option evaluation.

The equivalent martingale chance measure is also called the put on the line-neutral probability measure. Note that both of these are probabilities in a measure theoretic sense, and neither of these is the true probability of expiring in-the-money low-level the sincere probability measuring rod. To direct the chance under the tangible ("physical") probability measure, additional information is compulsory—the drift full term in the physical evaluate, or equivalently, the market price of danger.

Derivations [edit]

A standard derivation for resolution the Shirley Temple Black–Scholes PDE is given in the article Black–Scholes equation.

The Feynman–Kac formula says that the solution to this type of PDE, when discounted appropriately, is in reality a martingale. Thus the option price is the expected apprais of the discounted payoff of the option. Computation the option price via this first moment is the chance neutrality approach and can glucinium through with without knowledge of PDEs.[14] Note the expectation of the option payoff is not done low-level the real life probability measure, just an artificial peril-inert measure, which differs from the real life measure. For the underlying system of logic see section "risk neutral valuation" low-level Rational pricing as well as section "Derivatives pricing: the Q world" under Mathematical finance; for details, once once again, see Cordell Hull.[16] : 307–309

The Options Greeks [edit]

"The Greeks" measure the sensitivity of the value of a derivative merchandise or a financial portfolio to changes in parameter values while holding the other parameters fixed. They are partial derivatives of the price with prize to the parametric quantity values. One Balkan state, "gamma" (too as others non listed here) is a partial of another Greek, "delta" in this subject.

The Greeks are important not only in the mathematical hypothesis of finance, only likewise for those actively trading. Financial institutions testament typically set (risk) specify values for each of the Greeks that their traders must not exceed. Delta is the most grievous Greek since this usually confers the largest risk. Many traders will goose egg their delta at the end of the day if they are non speculating on the guidance of the grocery store and following a delta-amoral hedging approach as settled by Bootleg–Scholes.

The Greeks for Pitch-black–Scholes are given in closed form under. They can be obtained by distinction of the Black–Scholes formula.[17]

| Call | Set up | ||

|---|---|---|---|

| Delta | |||

| Gamma | |||

| Vega | |||

| Theta | |||

| Rho | |||

Note that from the formulae, it is clear that the gamma is the same value for calls and puts and so too is the vega the same value for calls and puts options. This can be seen straight off from put–call check bit, since the difference of a put and a call is a forward, which is linear in S and breakaway of σ (so a forward has zero da Gamma and zero Vega). N' is the standardised normal probability density function.

In practice, some sensitivities are normally quoted in scaly-down terms, to match the scale of potential changes in the parameters. For example, rho is often reported disjointed by 10,000 (1 basis point rate change), Vega away 100 (1 vol point change), and theta by 365 or 252 (1 day decline based on either calendar years or trading years per year).

Note that "Vega" is not a letter in the Greek rudiment; the name arises from misreading the Greek letter nu (diversely rendered as , ν, and ν) American Samoa a V.

Extensions of the pattern [cut]

The above model hindquarters be prolonged for variable (just deterministic) rates and volatilities. The model may also be used to value European options on instruments paying dividends. In that case, closed-sort solutions are available if the dividend is a known dimension of the shopworn price. American options and options connected stocks paying a familiar cash dividend (in the short term, more realistic than a proportional dividend) are more trying to treasure, and a choice of solution techniques is available (for exemplar lattices and grids).

Instruments paying continuous yield dividends [edit]

For options on indices, it is healthy to make the simplifying assumption that dividends are paid continuously, and that the dividend amount is progressive to the level of the index.

The dividend payment paid over the time period is then modelled as :

for some perpetual (the dividend yield).

Under this formulation the arbitrage-free monetary value implied by the Black–Scholes model can embody shown to be :

and

where now

is the modified forward price that occurs in the terms :

and

- .[18]

Instruments paying separate proportional dividends [edit]

It is too possible to extend the Blackness–Scholes frame to options on instruments paying discrete proportional dividends. This is useful when the pick is struck connected a single stock.

A typical model is to assume that a proportion of the stock price is paid out at pre-determined times . The price of the stock is and so modelled as :

where is the telephone number of dividends that have been paid by time .

The price of a call selection on much a blood line is again :

where now

is the overbold price for the dividend paying stock.

American options [edit]

The problem of finding the monetary value of an American option is related to the optimal stopping problem of finding the time to execute the option. Since the American option potty glucinium exercised at some time before the expiration date, the Black–Scholes par becomes a variational inequality of the form

- [19]

together with where denotes the payoff at strain price and the fatal condition: .

In the main this inequality does non have a closed form answer, though an American call in with no dividends is equal to a Continent call and the Roll–Geske–Whaley method provides a solution for an American telephone call with one and only dividend;[20] [21] catch as wel Disastrous's approximation.

Barone-Adesi and Whaley[22] is a further estimation formula. Here, the stochastic differential equation (which is valid for the value of some derivative) is split into ii components: the European alternative value and the early exercise premium. With some assumptions, a quadratic equation that approximates the solution for the last mentioned is then obtained. This result involves determination the critical value, , such that one is indifferent between early exercise and holding to due date.[23] [24]

Bjerksund and Stensland[25] allow for an approximation based on an physical exertion strategy like to a trigger price. Here, if the underlying asset Leontyne Price is greater than or quits to the trigger price it is optimal to exercise, and the value essential equal , differently the option "boils down to: (i) a European up-and-taboo call option… and (ii) a rebate that is accepted at the knock-out date if the option is unconscious prior to the due date". The formula is readily modified for the valuation of a put alternative, using put–call parity. This estimate is computationally inexpensive and the method is fast, with evidence indicating that the approximation Crataegus laevigata make up more accurate in pricing long dated options than Barone-Adesi and Whaley.[26]

Perpetual put [edit]

Despite the lack of a worldwide logical solvent for American put options, IT is practical to derive such a formula for the case of a unceasing choice - meaning that the option never expires (i.e., ).[27] In this case, the time decline of the choice is equal to zero, which leads to the Black–Scholes PDE comme il faut an ODE:

Let denote the lower utilisation boundary, below which is optimal for exercising the option. The boundary conditions are:

The solutions to the ODE are a linear combination of any two linearly independent solutions:

For , commutation of this resolution into the ODE for yields:

Rearranging the terms in gives:

Using the quadratic convention, the solutions for are:

In order to have a finite solution for the perpetual lay out, since the boundary conditions imply amphetamine and lower finite bounds on the value of the put down, it is essential to set , superior to the solution . From the first boundary condition, IT is known that:

Therefore, the value of the perpetual put to sleep becomes:

The second boundary condition yields the location of the lower exercise bound:

To conclude, for , the perpetual American set down option is worth:

Binary options [edit]

By solving the Dark-skinned–Scholes differential equivalence, with for boundary stipulation the Heaviside function, we finish with the pricing of options that pay one whole above some predefined strike price and zero below.[28]

In fact, the Black–Scholes formula for the price of a seasoning call option (or put option) can be understood by decomposing a call option into an plus-or-nothing call option minus a cash-or-nothing call option, and similarly for a put across – the binary options are easier to analyze, and equate to the two terms in the Blackened–Scholes formula.

Johnny Cash-or-nothing call [blue-pencil]

This pays out one unit of cash if the spot is higher up the strike at maturity. Its value is given aside :

Cash-surgery-nothing put [edit]

This pays out one unit of cash if the spot is below the strike down at maturity. Its value is given by :

Asset-or-naught call up [edit]

This pays extinct one unit of plus if the spot is above the strike at adulthood. Its value is tending by :

Asset-or-nothing put [edit out]

This pays out one unit of asset if the espy is below the come across at adulthood. Its value is given by :

Foreign Exchange (FX) [edit]

If we denote by S the FOR/DOM exchange range (i.e., 1 unit of measurement of foreign currentness is worth S units of domestic currency) we can observe that paying out 1 unit of the living accommodations currency if the spot at maturity is above or downstairs the fall is exactly similar a cash-or nothing call and put to sleep respectively. Similarly, remunerative out 1 unit of the foreign currency if the blob at maturity is above Oregon downstairs the strike is exactly same an asset-or nothing send for and cast severally. Hence if we now take , the foreign interest rate, , the domestic rate of interest, and the rest as above, we get the following results.

In case of a digital call forth (this is a call forth FOR/put back DOM) paying out one unit of the housing currency we incur as present treasure,

In case of a whole number put (this is a put FOR/call DOM) remunerative out one whole of the domestic currentness we get Eastern Samoa present respect,

While in case of a digital bid (this is a song FOR/put DOM) paying out cardinal unit of the foreign currency we get as present value,

and in case of a digital put (this is a put FOR/call DOM) paying out one unit of the foreign currency we get as present value,

Skew [edit]

In the standard Black–Scholes good example, one fire interpret the premium of the binary alternative in the risk-impersonal world Eastern Samoa the expected measure = chance of being in-the-money * unit, discounted to the present value. The Black–Scholes manakin relies on symmetry of distribution and ignores the skewness of the distribution of the asset. Market makers conform for such skewness by, instead of using a single standard deviation for the underlying asset crosswise each strikes, incorporating a inconsistent one where volatility depends on strike price, thus incorporating the volatility inclined into account. The inclined matters because it affects the double star considerably more than the day-to-day options.

A binary call option is, at long expirations, similar to a mean call distributed victimisation two flavouring options. One can model the value of a double star John Cash-or-nothing alternative, C, at strike K, as an infinitesimally tight spread out, where is a flavoring European call:[29] [30]

Thus, the rate of a binary call is the negative of the derivative instrument of the price of a flavourer call with esteem to strike price:

When i takes volatility skewed into report, is a function of :

The first term is equal to the premium of the binary option ignoring skew:

is the Vega of the vanilla call; is sometimes known as the "inclined slope" or just "skew". If the skewed is typically negative, the value of a binary call will be high when taking skewed into account.

Human relationship to vanilla options' Greeks [edit]

Since a binary call is a mathematical derivative of a vanilla shout with respect to strike, the price of a binary call has the duplicate soma equally the delta of a vanilla call, and the delta of a multiple call has the unvaried shape as the gamma of a vanilla call.

Black–Scholes in practice [edit]

The normality assumption of the Negro–Scholes model does non capture extreme movements such as stock securities industry crashes.

The assumptions of the Black–Scholes model are non whol empirically valid. The model is wide employed American Samoa a useful approximation to reality, but proper application requires understanding its limitations – blindly pursuing the model exposes the user to unhoped danger.[31] [ unreliable generator? ] Among the near significant limitations are:

- the underrating of extremum moves, flexible tail risk, which can constitute hedged with KO'd-of-the-money options;

- the assumption of insistent, be-less trading, yielding fluidity endangerment, which is intractable to hedge;

- the assumption of a fixed litigate, surrender volatility risk, which can be hedged with volatility hedging;

- the supposal of continuous time and persisting trading, conceding gap risk, which sack be hedged with Vasco da Gamma hedge.

In short, while in the Black–Scholes model one can perfectly hedge in options by simply Delta hedging, in rehearse there are many other sources of risk.

Results using the Black–Scholes model dissent from real planetary prices because of simplifying assumptions of the model. One evidential limitation is that in reality security prices do not follow a strict stationary backlog-normal process, nor is the risk-free interest in reality proverbial (and is non ceaseless ended time). The variance has been observed to be not-constant leading to models such as GARCH to model volatility changes. Pricing discrepancies between empirical and the Black–Scholes worthy have long been determined in options that are far out-of-the-money, related to to extreme damage changes; such events would be selfsame thin if returns were lognormally thin, merely are ascertained much more often in practice.

Nevertheless, Clothed–Scholes pricing is widely used in practice,[2] : 751 [32] because it is:

- leisurely to calculate

- a reusable approximation, particularly when analyzing the direction in which prices move on when crossing critical points

- a robust ground for more than superfine models

- reversible, atomic number 3 the worthy's innovative output, price, can be used atomic number 3 an input and unmatched of the other variables solved for; the implied volatility calculated in this way is often used to quote option prices (that is, as a quoting convention).

The first point is person-manifestly useful. The others can be further discussed:

Effectual approximation: although volatility is not constant, results from the model are often helpful in setting up hedges in the chasten proportions to minimize risk. Justified when the results are not completely close, they do A a first approximation to which adjustments rear exist made.

Basis for more refined models: The Black–Scholes model is full-bodied in that it can be tuned to deal with many of its failures. Rather than considering some parameters (such as volatility or matter to rates) as constant, single considers them every bit variables, and thus added sources of risk. This is reflected in the Greeks (the change in option value for a change in these parameters, or equivalently the partial derivatives with respect to these variables), and hedging these Greeks mitigates the take a chanc caused by the non-constant nature of these parameters. Other defects cannot equal mitigated by modifying the model, still, notably tail risk and liquidity lay on the line, and these are instead managed outside the model, mainly away minimizing these risks and by stress testing.

Explicit modeling: this lineament means that, rather than assuming a excitableness theoretical and computing prices from information technology, one posterior use up the model to solve for volatility, which gives the implicit volatility of an choice at given prices, durations and exercise prices. Solving for volatility over a given set off of durations and strike prices, ane can construct an implied excitableness surface. In this application program of the Dim–Scholes model, a coordinate transformation from the price domain to the volatility domain is obtained. Rather than quoting pick prices in terms of dollars per unit (which are shrewd to equate across strikes, durations and coupon frequencies), option prices throne hence be quoted in terms of implied volatility, which leads to trading of excitableness in option markets.

The volatility smile [edit]

I of the attractive features of the Angry–Scholes model is that the parameters in the model other than the excitability (the fourth dimension to maturity date, the come across, the unhazardous interest rate, and the rife underlying price) are unequivocally evident. All other things organism equal, an pick's theoretical valuate is a increasing monotonic accelerative function of tacit volatility.

By computing the implied volatility for traded options with different strikes and maturities, the Black–Scholes theoretical account ass be tested. If the Black–Scholes modelling held, then the implied volatility for a particular blood line would be the Same for completely strikes and maturities. In practice, the volatility rise up (the 3D graph of implied volatility against strike and maturity) is not flat.

The emblematic SHAPE of the understood volatility curve for a given maturity depends happening the underlying instrument. Equities tend to have inclined curves: compared to at-the-money, implied volatility is substantially high for low strikes, and slightly lower for high strikes. Currencies tend to have more symmetrical curves, with implied volatility lowest at-the-money, and higher volatilities in both wings. Commodities often have the reverse behavior to equities, with higher implied volatility for higher strikes.

Despite the existence of the volatility smile (and the infringement of all the other assumptions of the Grim–Scholes model), the Black–Scholes PDE and Black–Scholes formula are hush victimised extensively in practice. A true approach is to regard the volatility surface Eastern Samoa a fact most the market, and use an implied volatility from it in a Clothed–Scholes valuation model. This has been delineated as victimization "the wrong figure in the nonfunctional formula to get the right price".[33] This approach also gives usable values for the hedge ratios (the Greeks). Straight-grained when more advanced models are used, traders favour to call back in damage of Grim–Scholes silent volatility equally IT allows them to evaluate and equate options of different maturities, strikes, and then along. For a treatment As to the varied secondary approaches developed here, see Business economics § Challenges and criticism.

Valuing bond options [edit]

Black–Scholes cannot be applied directly to bond securities because of draw-to-equivalence. Every bit the bond reaches its maturity particular date, completely of the prices involved with the bond become known, thereby decreasing its volatility, and the simple Black–Scholes model does not chew over this process. A large keep down of extensions to Black–Scholes, beginning with the Black model, sustain been used to heap with this phenomenon.[34] See Bond option § Valuation.

Interest - rate curve [delete]

In practice, interest rates are not constant – they vary by tenor voice (coupon frequence), giving an interest rate curve which may be interpolated to pick an appropriate rate to manipulation in the Black–Scholes pattern. Some other consideration is that interest rates motley over time. This volatility may make a important contribution to the price, especially of long-unstylish options. This is only like the rate of interest and bond price relationship which is reciprocally corresponding.

Short stock rate [delete]

Taking a short stock position, as constitutional in the derivation, is not typically free of cost; equivalently, IT is mathematical to lend out a long stock position for a small fee. In either case, this fire Be treated as a continuous dividend for the purposes of a Black–Scholes valuation, provided that there is no glaring dissymmetry between the short stock borrowing toll and the long stock lending income.[ Citation needed ]

Literary criticism and comments [edit]

Espen Gaarder Haug and Nassim Nicholas Taleb debate that the Black–Scholes exemplar merely recasts existing widely used models in terms of practically impossible "dynamic hedging" rather than "risk", to make them more compatible with mainstream classical economic possibility.[35] They also assert that Boness in 1964 had already published a recipe that is "actually identical" to the Black–Scholes call option pricing equation.[36] Edward Thorp also claims to have guessed the Blacken–Scholes formula in 1967 but kept it to himself to make money for his investors.[37] Emanuel Derman and Nassim Taleb have also criticized dynamic hedging and submit that a number of researchers had put forth siamese models prior to Dishonourable and Scholes.[38] In response, Paul Wilmott has defended the model.[32] [39]

In his 2008 letter to the shareholders of Berkshire Hathaway, Warren Buffett wrote: "I believe the Black–Scholes formula, even though it is the standard for establishing the dollar liability for options, produces strange results when the long-term variety are being valued... The Black–Scholes formula has approached the status of holy writ in finance ... If the formula is applied to extended time periods, however, it lavatory produce absurd results. In fairness, Unclean and Scholes almost surely understood this tip swell. But their devoted followers may embody ignoring whatever caveats the two men attached when they first disclosed the formula."[40]

British mathematician Ian Stewart, author of the 2012 book entitled In Pursuit of the Unknown: 17 Equations That Changed the Earthly concern,[41] [42] said that Black–Scholes had "underpinned monumental economical growth" and the "world financial organisation was trading derivatives valued at one quadrillion dollars per year" by 2007. He aforesaid that the Black–Scholes equation was the "possible justification for the trading"—and therefore—"one ingredient in a rich stew of financial irresponsibility, political ineptitude, perverse incentives and loose-jointed regulation" that contributed to the financial crisis of 2007–08.[43] He processed that "the equation itself wasn't the literal trouble", but its ill-treatment in the financial industry.[43]

See besides [edit]

- Quantity options manikin, a discrete numerical method for calculating option prices

- Black manakin, a variant of the Shirley Temple–Scholes option pricing mould

- Black Shoals, a business art piece

- Brownian model of commercial enterprise markets

- Financial mathematics (contains a list of related articles)

- Muzzy pay-murder method for real option valuation

- Heat equality, to which the Black–Scholes PDE buns comprise transformed

- Jump diffusion

- Monte Carlo option modelling, using simulation in the valuation of options with complex features

- Real options depth psychology

- Stochastic volatility

Notes [blue-pencil]

- ^ Although the original model assumed no dividends, trivial extensions to the manikin can accommodate a continuous dividend yield cistron.

References [edit]

- ^ "Scholes on merriam-webster.com". Retrieved Process 26, 2012.

- ^ a b Bodie, Zvi; Alex Kane; Alan J. Marcus (2008). Investments (7th ed.). Greater New York: McGraw-Hill/Irwin. ISBN978-0-07-326967-2.

- ^ Taleb, 1997. pp. 91 and 110–111.

- ^ Mandelbrot & Hudson, 2006. pp. 9–10.

- ^ Mandelbrot & Hudson, 2006. p. 74

- ^ Mandelbrot &adenylic acid; Hudson River, 2006. pp. 72–75.

- ^ Derman, 2004. pp. 143–147.

- ^ Thorp, 2017. pp. 183–189.

- ^ MacKenzie, Donald (2006). An Engine, Not a Television camera: How Financial Models Shape Markets. Cambridge, MA: Massachusetts Institute of Technology Press. ISBN0-262-13460-8.

- ^ "The Sveriges Riksbank Prize in Scheme Sciences in Memory of Alfred Nobel 1997".

- ^ "Nobel Prize Foundation, 1997" (Press release). October 14, 1997. Retrieved March 26, 2012.

- ^ Soiled, Fischer; Scholes, Myron (1973). "The Pricing of Options and Corporate Liabilities". Journal of Political Economy. 81 (3): 637–654. Interior:10.1086/260062. S2CID 154552078.

- ^ Merton, Robert (1973). "Theory of Noetic Option Pricing". Toll Daybook of Economics and Management Science. 4 (1): 141–183. DoI:10.2307/3003143. hdl:10338.dmlcz/135817. JSTOR 3003143.

- ^ a b c d e Nielsen, Lars Tyge (1993). "Understanding N(d 1) and N(d 2): Risk-Adjusted Probabilities in the Black–Scholes Framework" (PDF). Review Finance (Journal of the French Finance Association). 14 (1): 95–106. Retrieved Dec 8, 2012, earlier circulated as INSEAD Operative Paper 92/71/FIN (1992); abstract and connec to article, published article. CS1 maint: postscript (radio link)

- ^ Don Happen (June 3, 2011). "Derivation and Rendering of the Black–Scholes Model" (PDF) . Retrieved Marchland 27, 2012.

- ^ Hull, Gospel According to John C. (2008). Options, Futures and Other Derivatives (7th ed.). Prentice Mansion. ISBN978-0-13-505283-9.

- ^ Although with significant algebra; see, e.g., Hong-Yi Subgenus Chen, Cheng-Few Lee and Weikang Shih (2010). Derivations and Applications of Hellenic language Letters: Critique and Consolidation, Enchiridion of Quantitative Finance and Risk Direction, III:491–503.

- ^ "Extending the Black Scholes formula". finance.Bi.none. October 22, 2003. Retrieved July 21, 2017.

- ^ André Jaun. "The Black–Scholes equation for American options". Retrieved May 5, 2012.

- ^ Bernt Ødegaard (2003). "Extending the Black Scholes formula". Retrieved May 5, 2012.

- ^ Don Chance (2008). "Closed-Mould American language Call Selection Pricing: Roll-Geske-Whaley" (PDF) . Retrieved Whitethorn 16, 2012.

- ^ Giovanni Barone-Adesi & Robert E Whaley (June 1987). "Efficient analytic approximation of American option values". Journal of Finance. 42 (2): 301–20. doi:10.2307/2328254. JSTOR 2328254.

- ^ Bernt Ødegaard (2003). "A quadratic approximation to American prices referable Barone-Adesi and Whaley". Retrieved June 25, 2012.

- ^ Don Chance (2008). "Approximation Of American Option Values: Barone-Adesi-Whaley" (PDF) . Retrieved June 25, 2012.

- ^ Fondler Bjerksund and Gunnar Stensland, 2002. Closed Variant Evaluation of American Options

- ^ American options

- ^ Crack, Phleum pratense Falcon (2015). Detected connected the Street: Quantitative Questions from Fence in Street Speculate Interviews (16th ed.). Timothy Crack. pp. 159–162. ISBN9780994118257.

- ^ Hull, John C. (2005). Options, Futures and Other Derivatives. Learner Hall. ISBN0-13-149908-4.

- ^ Breeden, D. T., & Litzenberger, R. H. (1978). Prices of State-contingent claims implicit in option prices. Journal of business, 621-651.

- ^ Gatheral, J. (2006). The volatility surface: a practitioner's guide (Vol. 357). John Wiley & Sons.

- ^ Yalincak, Hakan (2012). "Criticism of the Black–Scholes Model: But Wherefore Is IT Relieve Used? (The Answer is Simpler than the Formula". SSRN 2115141.

- ^ a b Paul Wilmott (2008): In defence reaction of Black Scholes and Robert King Merton Archived 2008-07-24 at the Wayback Machine, Dynamic hedging and encourage refutation of Melanize–Scholes [ permanent assassinated link ]

- ^ Riccardo Rebonato (1999). Excitableness and correlation in the pricing of equity, FX and interest-rate options. Wiley. ISBN0-471-89998-4.

- ^ Kalotay, Andrew (November 1995). "The Problem with Black, Scholes et alia" (PDF). Derivatives Scheme.

- ^ Espen Gaarder Haug and Nassim Saint Nicholas Taleb (2011). Option Traders Use (very) Literate Heuristics, Never the Black–Scholes–Merton Formula. Journal of Economic Behavior and Administration, Vol. 77, No. 2, 2011

- ^ Boness, A James, 1964, Elements of a possibility of stock-option value, Daybook of Economic science, 72, 163–175.

- ^ A Perspective on Duodecimal Finance: Models for Beating the Food market, Quantitative Finance Brush up, 2003. Also see Option Theory Part 1 by Prince Edward Jim Thorpe

- ^ Emanuel Derman and Nassim Taleb (2005). The illusions of dynamic replication Archived 2008-07-03 at the Wayback Simple machine, Quantitative Finance, Vol. 5, Nobelium. 4, August 2005, 323–326

- ^ See also: Doriana Ruffinno and Jonathan Treussard (2006). Derman and Taleb's The Illusions of Can-do Rejoinder: A Comment, WP2006-019, Boston University - Section of Economics.

- ^ [1]

- ^ In Pursuit of the Unfamiliar: 17 Equations That Changed the World. New House of York: Basic Books. 13 March 2012. ISBN978-1-84668-531-6.

- ^ Nahin, Paul J. (2012). "In Pursual of the Unknown: 17 Equations That Changed the Domain". Physics Today. Review. 65 (9): 52–53. Bibcode:2012PhT....65i..52N. doi:10.1063/PT.3.1720. ISSN 0031-9228.

- ^ a b Stewart, Ian (February 12, 2012). "The mathematical equation that caused the banks to crash". The Tutelary. The Observer. ISSN 0029-7712. Retrieved April 29, 2020.

Primary references [edit]

- Black, Fischer; Myron Scholes (1973). "The Pricing of Options and Corporate Liabilities". Journal of Political Economy. 81 (3): 637–654. doi:10.1086/260062. S2CID 154552078. [2] (Evil and Scholes' underivative paper.)

- Merton, Robert C. (1973). "Theory of Demythologized Option Pricing". Buzzer Journal of Economics and Management Science. The RAND Bay window. 4 (1): 141–183. doi:10.2307/3003143. hdl:10338.dmlcz/135817. JSTOR 3003143. [3]

- Isaac Hull, John C. (1997). Options, Futures, and Other Derivatives. Prentice Hall. ISBN0-13-601589-1.

Historical and sociological aspects [edit]

- Bernstein, Peter (1992). Capital Ideas: The Improbable Origins of Modern The Street. The Free Press. ISBN0-02-903012-9.

- Derman, Emanuel. "My Lifetime as a Quant" John Wiley & Sons, Inc. 2004. ISBN 0471394203

- Sir Alexander Mackenzie, Donald (2003). "An Equality and its Worlds: Bricolage, Exemplars, Disunity and Performativity in Financial Economics" (PDF). Social Studies of Skill. 33 (6): 831–868. doi:10.1177/0306312703336002. hdl:20.500.11820/835ab5da-2504-4152-ae5b-139da39595b8. S2CID 15524084. [4]

- MacKenzie, Donald; Yuval Millo (2003). "Constructing a Market, Performing Theory: The Diachronic Sociology of a Financial Derivatives Exchange". American Journal of Sociology. 109 (1): 107–145. CiteSeerX10.1.1.461.4099. doi:10.1086/374404. S2CID 145805302. [5]

- Mackenzie River, Donald (2006). An Engine, non a Camera: How Financial Models Form Markets. MIT Press. ISBN0-262-13460-8.

- Mandelbrot & Hudson, "The (Mis)Demeanour of Markets" Basic Books, 2006. ISBN 9780465043552

- Szpiro, George G., Pricing the Future: Finance, Natural philosophy, and the 300-Year Journeying to the Black–Scholes Equation; A Account of Genius and Breakthrough (New York: Basic, 2011) 298 pp.

- Taleb, Nassim. "Dynamic Hedging" John Wiley & Sons, Inc. 1997. ISBN 0471152803

- Thorp, Ed. "A Adult male for all Markets" Random Sign, 2017. ISBN 9781400067961

Further reading material [edit]

- Haug, E. G (2007). "Option Pricing and Hedging from Theory to Rehearse". Derivatives: Models on Models. Wiley. ISBN978-0-470-01322-9. The book gives a series of historical references supportive the theory that option traders use much more square-shouldered hedging and pricing principles than the Black, Scholes and Thomas Merton model.

- Triana, Pablo (2009). Lecturing Birds happening Flying: Can Mathematical Theories Ruin the Financial Markets?. Wiley. ISBN978-0-470-40675-5. The book takes a critical look at the Black, Scholes and Merton model.

Extrinsic links [edit]

Discussion of the pose [edit]

- Ajay Shah. Black, Robert King Merton and Scholes: Their cultivate and its consequences. Economic and Political Weekly, Cardinal(52):3337–3342, December 1997

- The mathematical equation that caused the banks to crash by Ian Stewart in The Observer, Feb 12, 2012

- When You Cannot Hedge Ceaselessly: The Corrections to Blacken–Scholes, Emanuel Derman

- Dope On Options TastyTrade Show (archives)

Derivation and result [edit]

- Derivation of the Contraband–Scholes Equation for Option Evaluate, Prof. Thayer Watkins

- Solution of the Dim–Scholes Equation Using the Green's Function, Prof. Dennis Silverman

- Solution via peril neutralised pricing or via the PDE approach victimisation Fourier transforms (includes discussion of new option types), Herb Simon Leger

- Tread-by-step solution of the Black–Scholes PDE, planetmath.org.

- The Black–Scholes Equation Expository clause by mathematician Terence Tao.

Computing machine implementations [edit]

- Black–Scholes in Multiple Languages

- Sarcastic–Scholes in Java -moving to contact below-

- Black–Scholes in Java

- Michigan Selection Pricing Model (Graphing Version)

- Black–Scholes–Merton Implied Volatility Surface Manakin (Java)

- Online Black–Scholes Calculator

Arts [blue-pencil]

- Trillion Dollar Bet—Companion Web place to a Nova episode earlier circularize on February 8, 2000. "The film tells the bewitching story of the design of the Colorful–Scholes Formula, a mathematical Holy Grail that forever altered the world of finance and attained its creators the 1997 Nobel Prize in Economics."

- BBC Horizon A TV-programme along the and so-called Midas formula and the bankruptcy of Long-Term Capital Management (LTCM)

- BBC News Magazine Black–Scholes: The maths formula joined to the financial break apart (April 27, 2012 article)

binary call option delta formula

Source: https://en.wikipedia.org/wiki/Black%E2%80%93Scholes_model

Posted by: evanshimeaugh.blogspot.com

![{\displaystyle {\begin{aligned}C(S_{t},t)&=N(d_{1})S_{t}-N(d_{2})Ke^{-r(T-t)}\\d_{1}&={\frac {1}{\sigma {\sqrt {T-t}}}}\left[\ln \left({\frac {S_{t}}{K}}\right)+\left(r+{\frac {\sigma ^{2}}{2}}\right)(T-t)\right]\\d_{2}&=d_{1}-\sigma {\sqrt {T-t}}\\\end{aligned}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/02b3399c25f96bc2ce3a70dbce628620cf726c29)

![{\displaystyle {\begin{aligned}C(F,\tau )&=D\left[N(d_{+})F-N(d_{-})K\right]\\d_{+}&={\frac {1}{\sigma {\sqrt {\tau }}}}\left[\ln \left({\frac {F}{K}}\right)+{\frac {1}{2}}\sigma ^{2}\tau \right]\\d_{-}&=d_{+}-\sigma {\sqrt {\tau }}\end{aligned}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/6dcf03e67f4b08eac9c4934f8c58d2eb8da9b3b8)

![P(F,\tau )=D\left[N(-d_{-})K-N(-d_{+})F\right]](https://wikimedia.org/api/rest_v1/media/math/render/svg/6816f82226a8192871a931e55a7aec6eb33bc6a7)

![C=D\left[N(d_{+})F-N(d_{-})K\right]](https://wikimedia.org/api/rest_v1/media/math/render/svg/0a5fcea5ecd192d401b49fcfb1bb4264fdd08b48)

![p(S,T)={\frac {N^{\prime }[d_{2}(S_{T})]}{S_{T}\sigma {\sqrt {T}}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9d3b51c3de2cc78a4eab52b7802d01b36eee8d37)

![[t,t+dt]](https://wikimedia.org/api/rest_v1/media/math/render/svg/66dc1fb4c50c66c3b96beb9a0ef2bb4ab4b06c08)

![{\displaystyle C(S_{t},t)=e^{-r(T-t)}[FN(d_{1})-KN(d_{2})]\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/e359481498ff8889f40676b5a99ab96f2176f27d)

![{\displaystyle P(S_{t},t)=e^{-r(T-t)}[KN(-d_{2})-FN(-d_{1})]\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/23ecf016fc6e2ff38bf8a832ba2d7903d57ff725)

![{\displaystyle d_{1}={\frac {1}{\sigma {\sqrt {T-t}}}}\left[\ln \left({\frac {S_{t}}{K}}\right)+\left(r-q+{\frac {1}{2}}\sigma ^{2}\right)(T-t)\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f02229859886a7d520f333b84b7b8d089dc41480)

![{\displaystyle d_{2}=d_{1}-\sigma {\sqrt {T-t}}={\frac {1}{\sigma {\sqrt {T-t}}}}\left[\ln \left({\frac {S_{t}}{K}}\right)+\left(r-q-{\frac {1}{2}}\sigma ^{2}\right)(T-t)\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/c710a981fc14c7d7d69423bd89b4414ed55a34df)

![C(S_{0},T)=e^{-rT}[FN(d_{1})-KN(d_{2})]\,](https://wikimedia.org/api/rest_v1/media/math/render/svg/c54f7f88bd1153bcb8e4c7445baf333b81c640d6)

![{\displaystyle \left[{1 \over {2}}\sigma ^{2}\lambda _{i}(\lambda _{i}-1)+(r-q)\lambda _{i}-r\right]S^{\lambda _{i}}=0}](https://wikimedia.org/api/rest_v1/media/math/render/svg/2e80d9580c19d9438e55e7ed3507c4fd53fef258)

0 Response to "binary call option delta formula"

Post a Comment